How to Dispute Errors on Your Credit Report

Sky Blue Credit – The Smarter Credit Repair Solution

Faster disputes, credit rebuilding, debt validation, and more.

Stop losing money to bad credit.

Fix your credit with Sky Blue.

It can be a hard truth to stomach, but credit-report errors are much more common than you think. If you spot inaccurate, outdated, or incomplete information on your credit report, you’re not alone. According to a study by the FTC, about 21% of Americans reported finding at least one mistake, 13% verified errors that hurt their credit scores, and 5% ended up being denied or paying more for credit because of serious credit-reporting inaccuracies*.

Humans are fallible, yes, but if that human mistake is going to affect your ability to buy, rent, get a loan, or find a job, you should probably do the needful to rectify it. In this article, we’re showing you two ways to dispute errors on your credit reports. Read on…

How to dispute credit report errors

How to dispute credit report errors

There are several types of errors that can make their way to your credit report. It could be a misspelling of your personally identifiable information (identity-related errors), inaccuracies with your account status, balance errors, and other kinds of data mixups.

Here are two ways you can fix errors on your credit report: manually and automatically (Recommended).

Method 1: File a dispute manually

According to the Fair Credit Reporting Act (FCRA), you have the right to dispute errors on your credit report – both with the credit bureaus and the creditors.

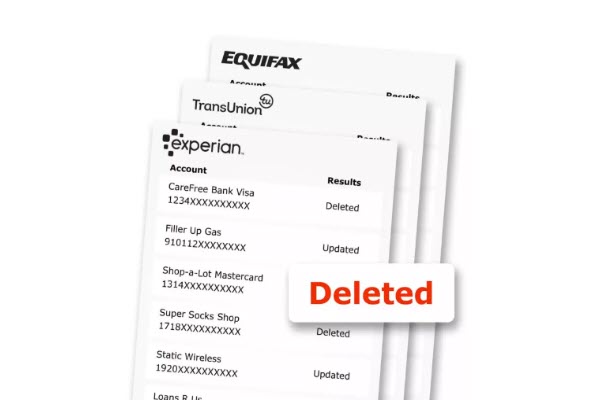

Option 1: Submit a dispute to the credit bureaus

To correct a mistake with the bureau, you will need to set up an account with the bureau, then select the item you want to dispute and provide the supporting evidence. For example, if you’re disputing a credit bill that is reported as late while indeed you paid on time, you should include a payment confirmation as proof. Once you’ve established the facts, request the error be deleted or corrected. Here is a sample dispute letter by the FTC to which you can refer.

You can dispute the errors online, by phone, and by mail. Below are the contact specifics for each:

| EQUIFAX | EXPERIAN | TRANSUNION | |

|---|---|---|---|

| Online | Equifax Personal Disputes | Experian Disputes | TransUnion Credit Freeze |

| Phone | (800) 864-2978 | (888) 397-3742 | (800) 916-8800 |

| Mail to: Equifax Information Services LLC P.O. Box 740256 Atlanta, GA 30348 | Mail to: Experian P.O. Box 4500 Allen, TX 75013 | Mail to: TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016 |

Option 2: File a dispute with the creditor

Creditors, also known as data furnishers, are companies that supply information to the bureau. As an option, you can reach out to these creditors to iron out the wrong entries. Likewise, you should include the following information in your dispute letter:

- Your name

- Your mailing address

- The item you’re disputing

- The reason why you dispute

- Supporting documentation

Wait for the response

After you’ve submitted a dispute, wait up to 35 days for the bureaus or furnishers to receive and investigate your case. If they agree with your claim, you’ll receive a corrected copy of your credit report. Additionally, you can ask the bureaus to send out the updated version to whoever pulls a credit report of you over the past 6 months. If your dispute is deemed “frivolous”, on the other hand, it means the bureau or the furnisher disagrees that the item is a mistake and makes no change to your credit report. In this case, you can either redispute it with new back-up materials or take it to the Consumer Financial Protection Bureau.

Method 2: Dispute credit report errors automatically (Recommended)

Credit report errors are unwelcome surprises. Sometimes it could take only one mistake to drag down your credit score and make you less credit-worthy to the lenders. So it’s crucial that you stay on top of your credit reports to avoid overpaying for your financial decisions down the line. If you don’t have the time or patience to do it manually, perhaps you can give Sky Blue Credit a try.

Sky Blue Credit is the most powerful solution to dispute credit report errors. Upon receiving your credit reports, Sky Blue will conduct a line-by-line review to discern even the most subtle discrepancies, and leverage all opportunities for you to get a better score. With Sky Blue, you don’t have to be a pro at submitting credit report disputes.

Here is how to fix credit report errors with Sky Blue Credit:

- Go to the Sky Blue Credit Signup page and register.

- Follow the instructions to get free credit reports.

- Put your feet up as Sky Blue Credit pores over your credit history and challenge any questionable or inaccurate items with the credit bureaus.

- It could take the bureaus up to 35 days to complete the disputes. According to user feedback, Sky Blue is known to be 10 days faster than the rest of the credit repair companies.

That’s it – manual and automatic ways to help you fix mistakes on your credit report. Hopefully, you will find this post useful. If you have any questions, ideas, or suggestions, please feel free to leave us a comment below.